Sprintax FAQ for International Employees & Students

Effective January 1, 2022, the Dartmouth College Payroll Office has partnered with

Sprintax Calculus, a leader in tax treaty benefit eligibility software, to ensure

Dartmouth College International Faculty, Staff, and Students remain compliant with

IRS regulations.

Effective January 1, 2022, the Dartmouth College Payroll Office has partnered with

Sprintax Calculus, a leader in tax treaty benefit eligibility software, to ensure

Dartmouth College International Faculty, Staff, and Students remain compliant with

IRS regulations.

General Overview

What is Sprintax Calculus?

Why Sprintax Calculus?

Who Can Use Sprintax Calculus?

How Does Sprintax Calculus Work?

Is the Sprintax Calculus Website and My Data Secure?

Who Do I Contact with Questions?

Can I sign-up on my own, or do I need to be invited?

Once I'm registered, what is the link to my profile?

What is Sprintax Calculus?

Sprintax Calculus is a tool to ensure that Dartmouth College International Faculty, Staff, and Students remain compliant with IRS regulations.

The system will aid employees in determining their residency status and tax treaty benefit entitlements, as well as filing their tax returns (only available to non-residents).

Why Sprintax Calculus?

Partnering with Sprintax Calculus allows Dartmouth College International Faculty, Staff, and Students the peace of mind that comes with being assure that they are taxed correctly and that the right amounts are reported to the IRS. Sprintax Calculus has a dedicated staff of international tax professionals available 24/7 to answer your questions via email, telephone, or chat.

Additionally, when the tax deadlines roll around, Sprintax Calculus integrates with Sprintax Tax Prep (administered by OVIS) to help all non-residents file fully compliant tax returns.

Who Can Use Sprintax Calculus?

All Dartmouth College International Faculty, Staff, Students (ie. Scholars, Teachers and Researchers) in the U.S. on F, J, M and Q visas can use the Sprintax Calculus software.

How Does Sprintax Calculus Work?

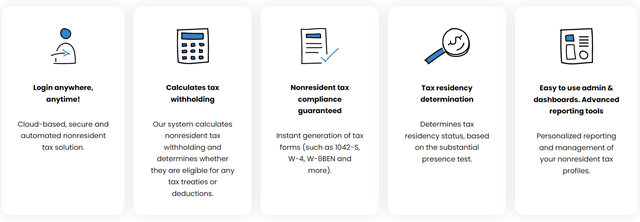

Login anywhere anytime! - Cloud-based, secure and automated nonresident tax solution.

Login anywhere anytime! - Cloud-based, secure and automated nonresident tax solution. - Calculates tax withholding - The Sprintax Calculus system calculates nonresident tax withholding and determines whether you are eligible for any tax treaties or deductions.

- Non-resident tax compliance guaranteed - Instant generation of tax forms (such as 1042-S, W-4, W-8BEN and more).

- Tax residency determination - Determines tax residency status, based on the substantial presence test.

- Easy to use admin & dashboards. Advanced reporting tools - Personalized reporting and management of your nonresident tax profiles.

Is the Sprintax Calculus Website and My Data Secure?

As a leading non-resident tax platform, Sprintax Calculus adheres to all IRS regulations on the retention of personable identifiable information in addition to GDPR (General Data Protection Regulation).

Security of information is a primary consideration for all the 450+ schools that Sprintax Calculus currently work with. Additionally, Sprintax Calculus is certified under ISO27001. ISO27001 is a globally recognized security standard that requires Sprintax Calculus to be externally regulated on security and other factors. All of Sprintax Calculus' servers and data are stored with Amazon Web Services which is a leading provider.

Who Do I Contact with Questions?

Dartmouth Payroll is always here to help. If you are interested in registering for a Sprintax Calculus account to determine your tax treaty eligibility, simply email us at Dartmouth.Payroll@dartmouth.edu and we will send you an activation link via email.

Can I register to Sprintax Calculus on my own, or do I need to be invited?

International employees should request a login from Dartmouth Payroll so that we can confirm you are not already in the system and not setting up a duplicate account.

Once I'm registered, how do I access my Sprintax Calculus profile?

Once you have been invited by Dartmouth Payroll and have registered, you can access your Sprintax Calculus profile at: https://tds.sprintax.com/uni/login/